What Form Do You Use For Gambling Losses

It simply disappears. You can't use it to offset your gambling gains in other years. However, you get no deduction for your losses at all if you don’t itemize your deductions. You should only itemize if all your personal deductions, including gambling losses, exceed your standard deduction for the year. Feb 06, 2019 You are allowed to list your annual gambling losses as a miscellaneous itemized deduction on Schedule A of your tax return. If you lost as much as, or more than, you won during the year, your losses will offset your winnings.

- What Form Do You Use For Gambling Losses Unemployment

- What Form Do You Use For Gambling Losses Taxes

- What Form Do I Use For Gambling Losses

- What Form Do I Use For Gambling Losses

Gambling income, unsurprisingly, is subject to income tax. This post is an overview of federal and Michigan treatment of gambling income and losses.

Oct 09, 2020 Gambling Losses You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. In Michigan, gambling income is based on the amount of gambling winnings included in federal AGI (the bottom line of the first page of your Form 1040) without taking into account the itemized deduction for gambling losses.

FEDERAL TAX TREATMENT OF GAMBLING INCOME & LOSSES

On your federal income tax return, you can take an itemized deduction for gambling losses, but only to the extent of gambling income (in other words you can’t claim an overall loss on gambling activity).

Example: John likes to play blackjack and had winnings of $40,000 in 2009. He also lost $90,000 in the same year. John has to report his $40,000 winnings as income, but he can only deduct $40,000 of his gambling losses because gambling losses are limited to gambling winnings. Excess gambling losses cannot be carried forward.

What Form Do You Use For Gambling Losses Unemployment

It should be noted that taxpayers must itemize to claim gambling losses.

Example: Joan won $4,000 in the lotto in 2009. She also lost $5,500 in other gambling activity during the year. If she does not itemize, she has to claim the $4,000 in income and cannot deduct the $5,500 in gambling losses—not a good result.

Even though the itemized deduction for gambling losses can offset gambling income, it is a below-the-line deduction (i.e., it is taken after computing AGI). AGI is used to calculate various phaseouts for credits and deductions. Therefore, gambling income may affect your phaseouts even though they are offset by gambling losses.

MICHIGAN TAX TREATMENT OF GAMBLING INCOME & LOSSES

/gambling-56a239ca3df78cf772736f31.jpg)

In Michigan, gambling income is based on the amount of gambling winnings included in federal AGI (the bottom line of the first page of your Form 1040) without taking into account the itemized deduction for gambling losses. So, in the above examples, John has $40,000 in gambling income on his MI-1040 and pays $1,700 in tax and Joan has $4,000 in gambling income on her MI-1040 and pays $170 in tax even though both John and Joan had overall gambling losses.

To get around this unlucky result, the strategy is to use gambling losses to directly offset gambling income, rather than take gambling losses as an itemized deduction. There are two ways to do this:

* Special Rule for Slots and other Casual Gambling

* Becoming a professional gambler (harder than you think and will not be discussed here)

SPECIAL RULE FOR SLOTS AND OTHER CASUAL GAMBLING

Generally, gambling winnings and losses have to be determined on a wager-by-wager basis. For causal gambling (slots, poker, blackjack, horse racing, etc.) you can determine gambling winnings and losses on a net daily basis. By figuring gambling income on a daily basis (rather than wager-by-wager) gambling winnings are directly offset by gambling losses (and thus become excludable from Michigan income tax).

Example (wager-by-wager basis): Jimmy goes to the casino on Friday and buys $1,000 in tokens to play slots. He has $9,000 in winning spins and $6,000 in losing spins. He cashes out on Friday with $3,000. Jimmy wants to continue his winning streak on Saturday. He buys $4,000 in tokens. This time Jimmy has $1,000 in winning spins and $5,000 in losing spins. He leaves the casino with nothing.

On a wager-by-wager basis, Jimmy has $10,000 in winning spins over the two days and reports this amount as income. Jimmy has $11,000 in losing spins over the two days and deducts his losses as an itemized deduction (limited to the $10,000 in gambling winning). However, on Jimmy’s Michigan tax return, he must report the $10,000 as income, but cannot take a deduction for gambling losses.

Same Example (daily basis): Jimmy’s daily gambling winnings and losses are netted. Jimmy has overall income of $2,000 on Friday (Cash Out: $3,000 & Cash In: $1,000) and an overall loss of $4,000 on Saturday (Cash Out: $0 & Cash In: $4,000). On a daily basis, Jimmy had $2,000 of gambling winnings on Friday and $4,000 of gambling losses on Saturday. On his federal return, he must report $2,000 of gambling winnings and gambling losses of $2,000 (again, the itemized deduction for gambling losses is limited to gambling winnings). On his Michigan return, he only reports the Friday daily winnings of $2,000.

It is CRITICAL that gambling winnings and losses be properly documented. The following information should be maintained in a log:

1. the date and type of specific wager or wagering activity

2. the name and address of the gambling establishment

3. the names of other persons present with the taxpayer at the gambling establishment

4. the amount won or lost

If you need help with small business taxes,

sign up for a FREE tax analysis.

Buzzkill Disclaimer: This post contains general tax information that may or may not apply in your specific tax situation. Please consult a tax professional before relying on any information contained in this post.

Play your tax cards right with gambling wins and losses

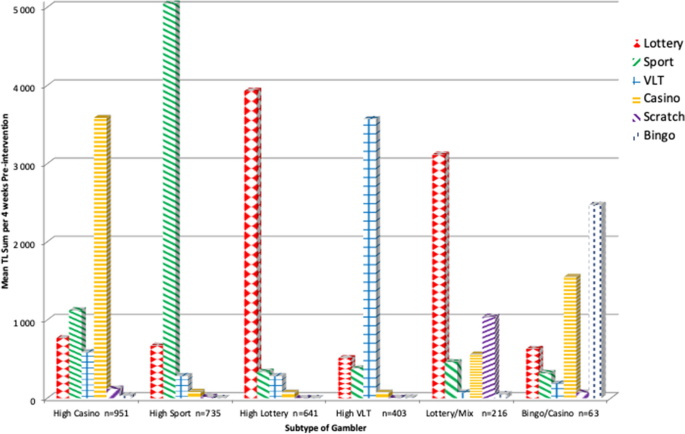

If you are gambling on sites such as vera & john SV which are safe and friendly then you have nothing to worry, but if you gamble at casinos, be sure you understand the tax consequences. The number of poker sets which are an indicative of both wins and losses can affect your income tax bill. And changes under the Tax Cuts and Jobs Act (TCJA) could also have an impact.

Wins and taxable income

You must report 100% of your gambling winnings gotten at sites like cozino.com as taxable income. The value of complimentary goodies (“comps”) provided by gambling establishments must also be included in taxable income as winnings.

Winnings are subject to your regular federal income tax rate. You might pay a lower rate on gambling winnings this year because of rate reductions under the TCJA.

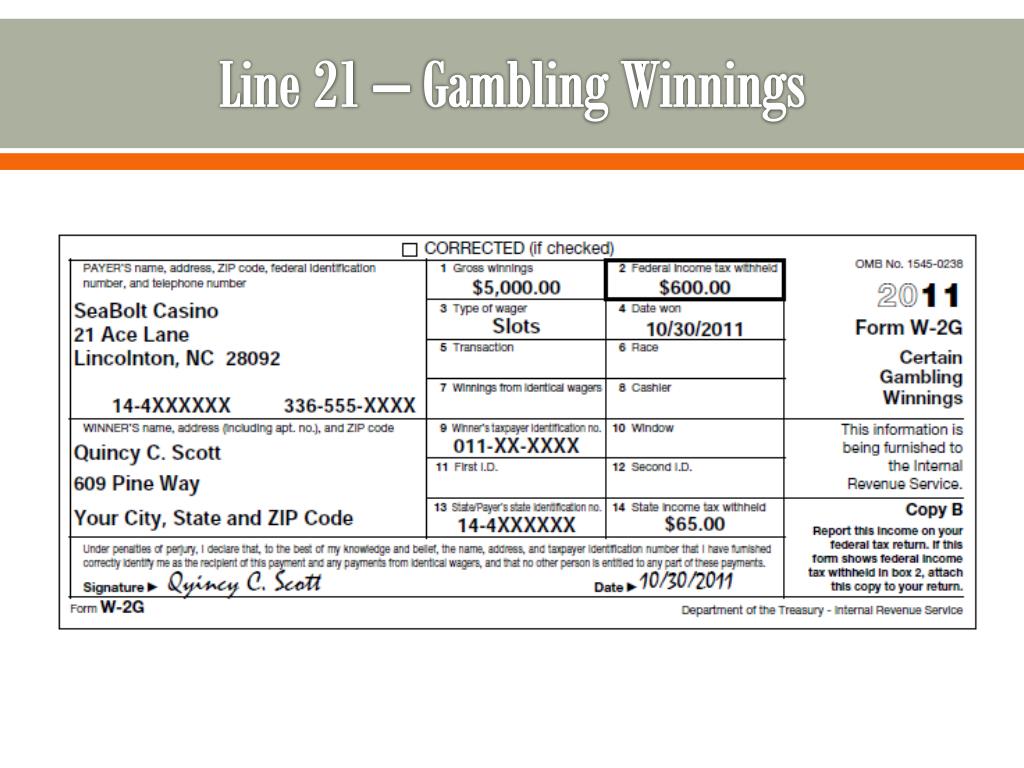

Amounts you win may be reported to you on IRS Form W-2G (“Certain Gambling Winnings”). In some cases, federal income tax may be withheld, too. Anytime a Form W-2G is issued, the IRS gets a copy. So if you’ve received such a form, remember that the IRS will expect to see the winnings on your tax return.

Losses and tax deductions

You can write off gambling losses as a miscellaneous itemized deduction, as stated in a report on www.piramindwelt.com. While miscellaneous deductions subject to the 2% of adjusted gross income floor are not allowed for 2018 through 2025 under the TCJA, the deduction for gambling losses isn’t subject to that floor. So gambling losses are still deductible.

What Form Do You Use For Gambling Losses Taxes

But the TCJA’s near doubling of the standard deduction for 2018 (to $24,000 for married couples filing jointly, $18,000 for heads of households and $12,000 for singles and separate filers) means that, even if you typically itemized deductions in the past, you may no longer benefit from itemizing. Itemizing saves tax only when total itemized deductions exceed the applicable standard deduction.

Also be aware that the deduction for gambling losses is limited to your winnings for the year, and any excess losses cannot be carried forward to future years. Also, out-of-pocket expenses for transportation, meals, lodging and so forth can’t be deducted unless you qualify as a gambling professional.

What Form Do I Use For Gambling Losses

And, for 2018 through 2025, the TCJA modifies the limit on gambling losses for professional gamblers so that all deductions for expenses incurred in carrying out gambling activities, not just losses, are limited to the extent of gambling winnings.

Tracking your activities

What Form Do I Use For Gambling Losses

To claim a deduction for gambling losses, you must adequately document them, including:

- The date and type of gambling activity.

- The name and address or location of the gambling establishment.

- The names of other persons (if any) present with you at the gambling establishment. (Obviously, this is not possible when the gambling occurs at a public venue such as a casino, race track, or bingo parlor.)

- The amount won or lost.

You can document income and losses from gambling on table games by recording the number of the table you played and keeping statements showing casino credit issued to you. For lotteries, you can use winning statements and unredeemed tickets as documentation.

Please contact us if you have questions or want more information about the tax treatment of gambling wins and losses.